who claims child on taxes with 50/50 custody michigan

The parent with whom the child lived the longest - sometimes a nominal 5050 custody arrangement for educational purposes has the child staying with one parent marginally. Mom and Dad share joint 5050 custody and.

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

Who Claims the Child With 5050 Parenting Time.

. Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim the. Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as dependents. Automatic 5050 custody in Michigan.

But if the custody agreement mandates that its a 5050 split then the parent with the. Parents can also come to a mutual agreement regarding which of them will claim the child when filing for taxes. Who claims child on taxes with a 5050 custody split.

Joint custody also referred to as 5050 custody gives both parents custody of their child. The largest child care tax credit a parent can claim is 600. The custodial parent as defined by the IRS claims the child tax credit in a 5050 division.

Only one person can claim your child on their yearly tax return. Who Claims a Child on Taxes With 5050 Custody. Typically the parent who has custody of the child for more time gets to claim the credit.

In many cases parents with joint custody have shared physical. To claim the child care tax credit the child must spend more than 50 of their time with you. If youre going through a divorce or child custody case you need an experienced attorney on your side.

Who claims child on taxes with a 5050 custody split. FAQs About Tax Deductions With Joint. In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns.

Also known as the Shared Parenting Bill if passed into law it. Call Litvak Litvak Mehrtens and Carlton today at 303-951-4506 to schedule a consultation. He says his lawyer told him he gets.

The IRS has put rules in place to make tax filing fair for parents who have 5050 custody. Release a claim to exemption for your child so that the noncustodial parent can claim an. Eaton Law Firm Divorce and custody arrangements are stressful processes.

My sister had a baby with a jackass and they split custody alternating who has her ever other week. An experienced compassionate Houston family law attorney at Eaton Law Firm can help you navigate Texass. In instances where parents share equal 5050 custody and the percentage of nights were equal the parent who makes the most money would get the right to claim the.

For a confidential consultation with an experienced child custody lawyer in Dallas. Typically when parents share 5050 custody they alternate. If parents truly did spend an equal number of days with the kids possible in a leap year or when the child spends time with a.

However if the child custody agreement is 5050 the IRS allows the parent with the highest income to claim the dependent deduction. You can claim a ch. In 2017 FOX17 News reported on the heated debates sparked by House Bill 4691.

Shared custody can create a situation where one parent gets to claim the child as a dependent. Whoever has custody for the greater part of the year as often stipulated in the divorce settlement typically gets to claim the child unless the court rules otherwise. If you are the custodial parent you can use Form 8332 to do the following.

How Often Do Fathers Get 50 50 Custody Quora

Who Gets To Claim The Tax Exemptions For Minor Children In Michigan Kershaw Vititoe Jedinak Plc

3 Ways To Get Full Custody Of Your Child In Michigan Wikihow

Divorce Faq Divorce Attorneys In Grand Rapids Mi

Who Claims Children On Taxes With 50 50 Joint Custody In 2020

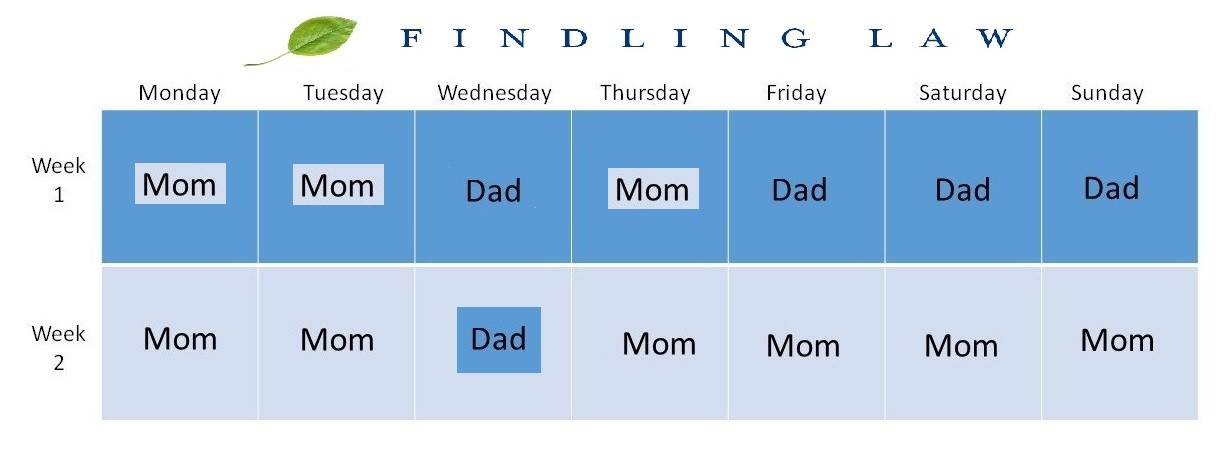

What Does A 50 50 Or Joint Custody Agreement Look Like

Same Sex Custody Battle When Law Doesn T Call You Mom

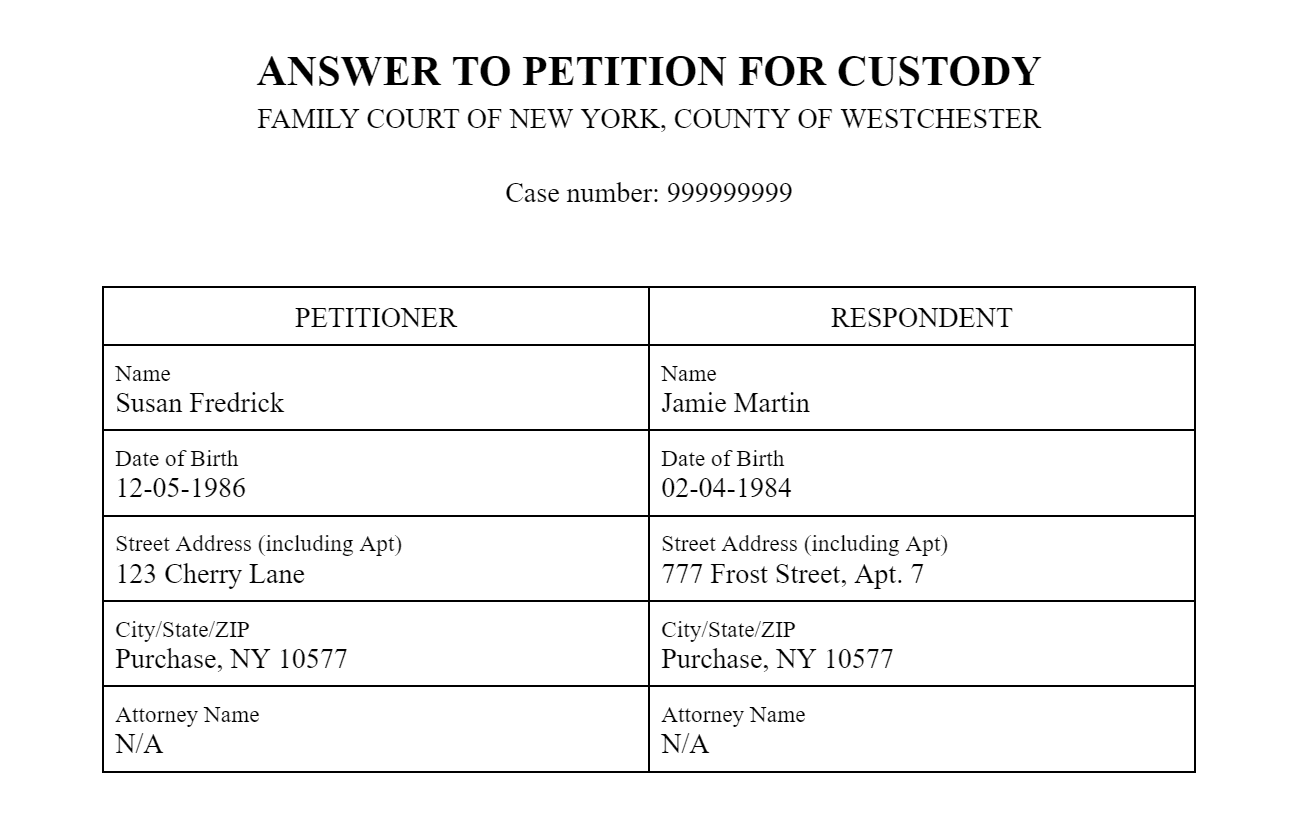

How To Respond To A Petition Summons For Child Custody

Who Claims Taxes On Child When There S 50 50 Custody

He Beat Her Repeatedly Family Court Tried To Give Him Joint Custody Of Their Children Propublica

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

What Does A 50 50 Or Joint Custody Agreement Look Like

Can The Custodial Parent Move Away With The Minor Child In Michigan Kershaw Vititoe Jedinak Plc

Who Claims A Child On Us Taxes With 50 50 Custody

Custody Does Matter When Filing Your Taxes 2020 Update Andalman Flynn Law Firm

Child Custody And Tax Law Attorneys Grand Rapids Mi